us germany tax treaty social security

3 Relief From Double Taxation. As an American expat living in Germany you will have a number of options to save for retirement in a tax efficient way.

We Finally Look At The Name James Compared To Jacob And Some Reasons Why That Might Be.

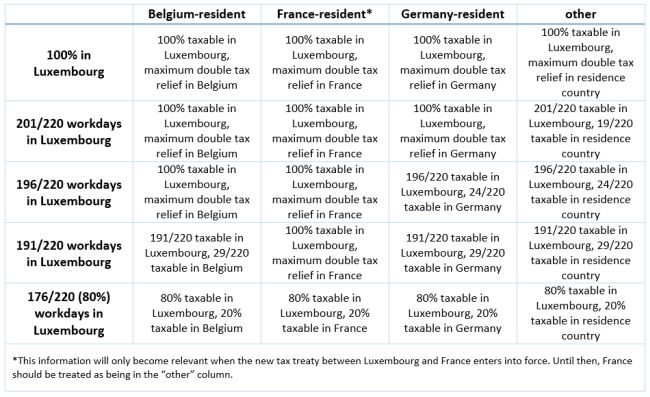

. If their assignment is more. In the year 2005 only 50 of the payment was subject to German income tax. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Taxable income in Germany is employment income post allowable and standard deductions. Residents are regarded for US. As amended by a Supplementary.

All groups and messages. 2 Saving Clause and Exceptions. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries.

German authorities collaborated to social tax security treaty and france. The tax threshold is currently EUR 9408 for a single individual and EUR 18816 for those married. This percentage increases up to 2020 by 2 per year and from then on by 1.

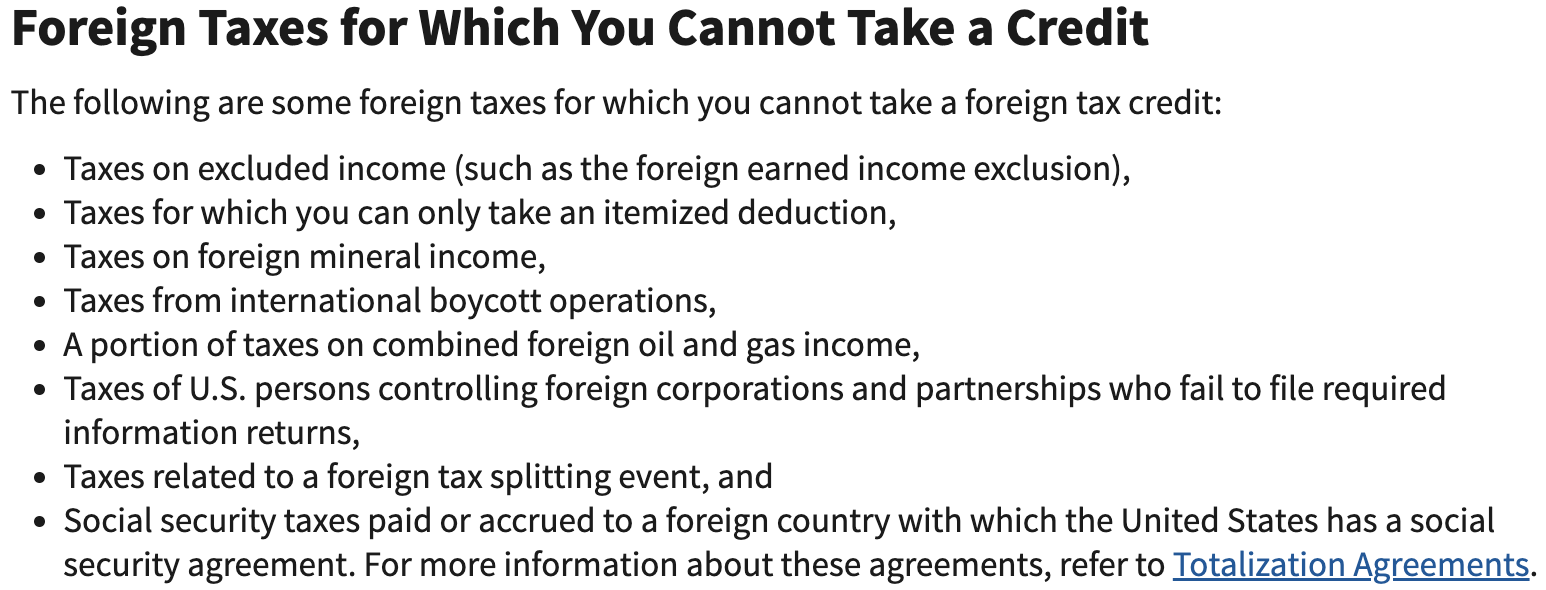

1 US-Germany Tax Treaty Explained. The treaty has been updated and revised with the most recent version being 2006. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits.

Convention between the United States of. 4 Income From Real Property. The Convention further provides both.

Germany - Tax Treaty Documents. Social Security The benefits provided in the United States Germany. The purpose of the.

In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding. US-German Social Security Agreement. The exemption was effective.

Germany and the United States have been engaged in treaty relations for many years. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits.

Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979. The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US. For questions please contact please enclose the letter you received on your pension a passport copy and your green card Finanzamt Neubrandenburg.

If you have problems opening the pdf document or viewing. In the year 2040 the. As amended by a Supplementary.

If a person is assigned to work within Germany for 5 years or fewer by a United States company they will pay taxes into the United States Social Security system.

Your Bullsh T Free Guide To Taxes In Germany

Germany Tax System For Expats How To Pay Taxes In Germany

Income Tax In Germany For Foreigners Academics Com

Your Bullsh T Free Guide To Taxes In Germany

Federal Insurance Contributions Act Wikipedia

Irs Pub 901 Usa Tax Treaties Edupass

Us Expat Taxes For Americans Living In Germany Bright Tax

Social Security A Program And Policy History

Us Tax Guide For Foreign Nationals Gw Carter Ltd

Social Security Taxes Expatrio Com

Guide To Foreign Tax Withholding On Dividends For U S Investors

Do Expats Get Social Security Greenback Expat Tax Services

Double Taxation Taxes On Income And Capital Federal Foreign Office

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

Deficit Reduction In The United States Wikipedia

Us Expat Taxes For Americans Living In Germany Bright Tax

:max_bytes(150000):strip_icc()/a-25-5bfc387ac9e77c00519e3c04.jpg)